One Big Beautiful Bill Act – (Part 3 of 3) – Impact on Student Loans

Personal note from Stan, Aug 1, 2025:

I am a first-generation physician from an immigrant family whose medical education was paid for by the private foundations of American families I’ve never met. They made possible everything that has happened in my life ever since.

Most American medical students who don’t come from means are not that lucky – the mean educational debt for the Class of 2024 was $212k1. It is to them, their mentors, and their advocates that I dedicate this post.

Important disclaimer: This post deals specifically with the One Big Beautiful Bill Act passed July 4, 2025. There have been and will be additional policies set by Executive Action or Department of Education (ED) policies that are constantly changing. I’ve noted these below in italics. This post was last updated Aug 1, 2025.

Key Updates:

- Medical students taking loans on or after July 1, 2026:

- Federal loans will be limited to $200k for all of med school (~$50k/yr) even if the cost of education is greater.

- The only two repayment options will be the Standard repayment plan and the newly created Repayment Assistance Program (RAP). Only the RAP will be eligible for loan forgiveness.

- Docs currently in Income-Driven Repayment (IDR) Plans:

- Save on a Valuable Education (SAVE), Pay as You Earn (PAYE) and Income-Contingent Repayment (ICR) will all be phased out by July 1, 2028; anyone left will transition to RAP.

- Income-Based Repayment (IBR) is the only IDR plan that will not be phased out for existing borrowers.

- Specifically for Docs currently in SAVE plan forbearance:

- It is only a matter of time until payments resume; start planning accordingly.

- No matter which path you choose, expect to make much higher payments than your pre-forbearance SAVE payments.

Background:

Before we describe what the One Big Beautiful Bill Act (OBBBA) does to student loans, let’s set the stage with a brief introduction to the pre-OBBBA Federal student loan landscape.

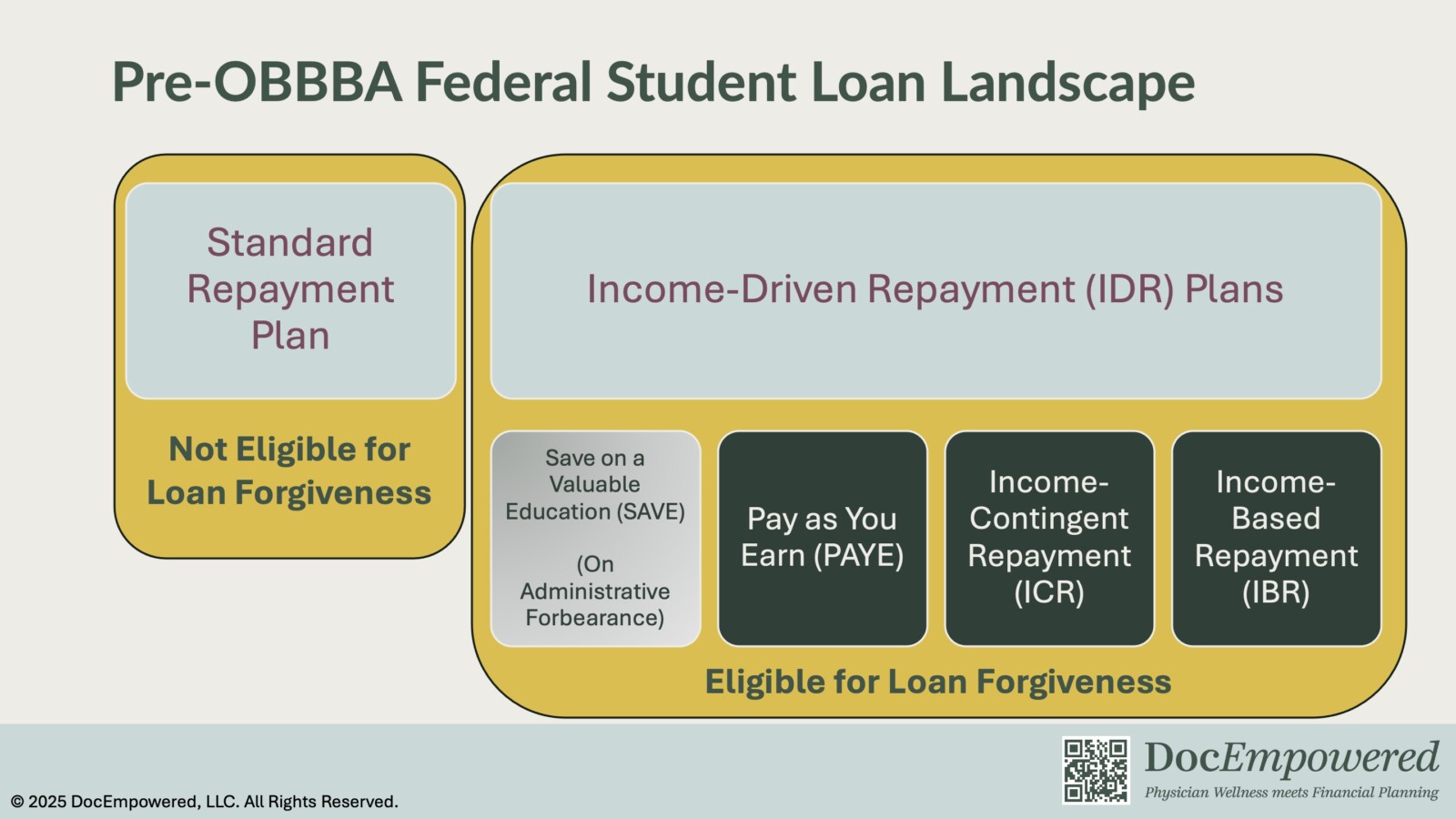

Alphabet soup insanity, I know. Pre-OBBBA, there were two paths to repayment in the Federal loan system: Standard Repayment or one of the Income-Driven Repayment (IDR) programs.

With Standard Repayment, you pay off your loan within 10 to 30 years (depending on the type and amount of loan you have). Your monthly payments are independent of your income, and loan forgiveness is not an option.

With Income-Driven Repayment (IDR) programs, your monthly payments are determined by your income and are therefore usually lower than the Standard Repayment plan during residency. The trade-off for the increased affordability is the increased interest accumulation and long-term cost. However, IDR plans also qualify for IDR loan forgiveness (previously after 20 to 25 years of payments) or Public Service Loan Forgiveness (PSLF; after 10 years working full-time for an eligible non-profit).

There are multiple IDR plans, and we won’t go through all of them. Importantly, the Save on a Valuable Education (SAVE) plan – easily the most generous IDR plan ever – has been in legal limbo ever since courts blocked its implementation. When OBBBA passed, millions of borrowers on SAVE were stuck in an “administrative forbearance”: no payments were due, but they were not earning any credit for loan forgiveness either.

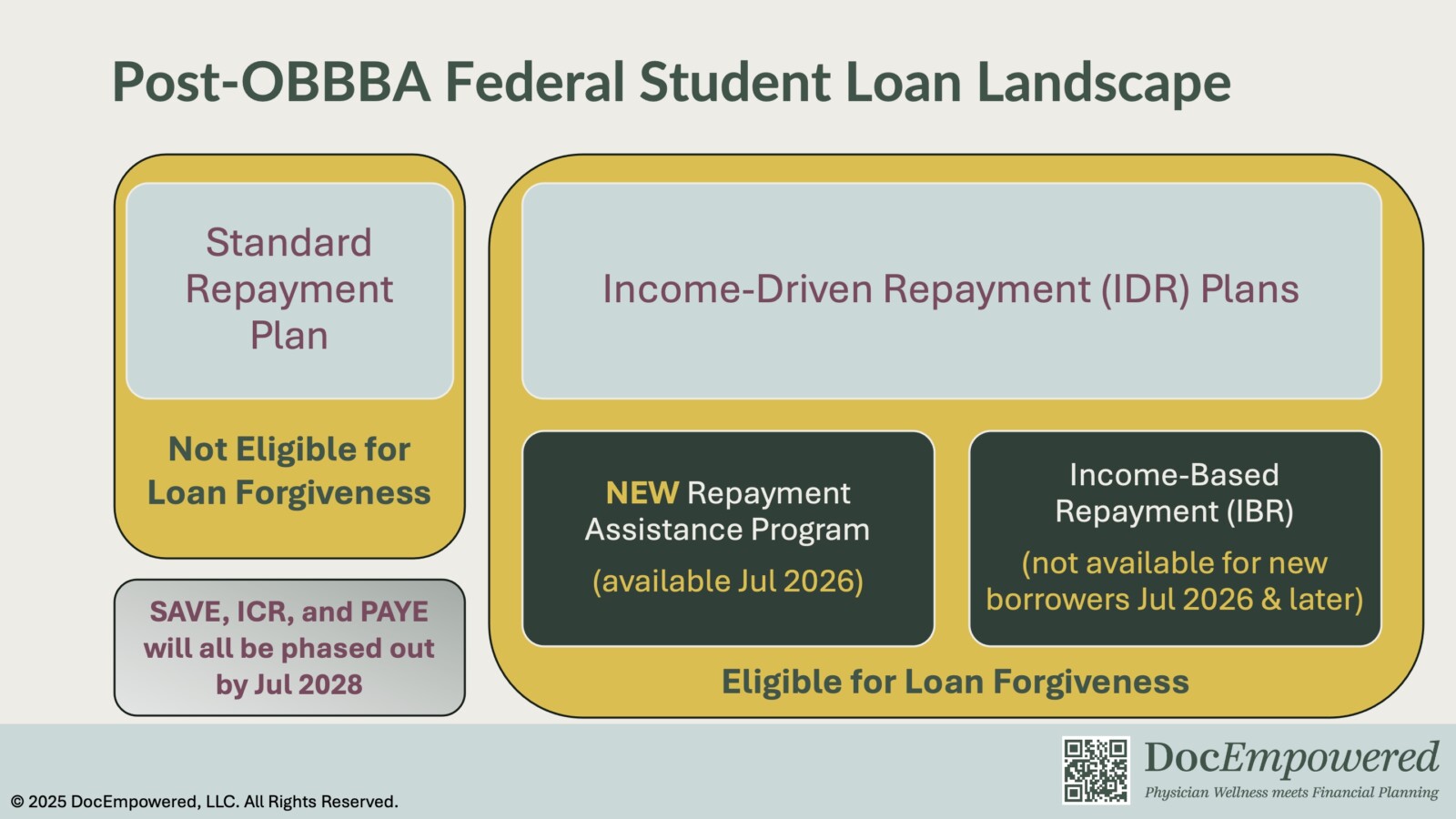

So that was immediately pre-OBBBA. Here is what OBBBA has done to the Federal Student Loan Landscape:

Note the key changes – IDR plans have been simplified to only two options, the existing IBR plan and a newly created Repayment Assistance Program (RAP), which is scheduled to be implemented July 2026. However, IBR will not be available for those borrowing loans on or after July 2026. SAVE, ICR, and PAYE are being eliminated.

What does this mean for different groups of docs/future docs? Let’s break down the takeaways for each group.

Current and Future Medical Students:

- Seek alternative funding if you need to borrow more than $50k for the 2026-27 school year or beyond.

- Your only options for repayment will be Standard Repayment, the RAP, or refinancing privately.

- Don’t let money drive your specialty decision, but pick a specialty and practice setting for a Debt-to-Income ratio of no greater than 2 if you want to have far more life options.

OBBBA also created a game-changing rule: beginning July 2026, you will only be allowed to borrow up to $200k total or $50k/yr assuming 4 years of med school. Previously, students were allowed to borrow up to the entire cost of attendance, and average med school debt at graduation in 2024 was $212k1. While med schools may eventually react by providing their own loans or lowering tuition, students may have to look elsewhere for funding in the meantime, such as private student loans.

With the pre-OBBBA loan programs, med students had multiple options to loan forgiveness. Now, the RAP is the only path to either IDR forgiveness (after a whopping 30 years) or PSLF (still 10 years). This matters incredibly. Medical students can no longer count on generous loan forgiveness programs and must consider their debt when choosing a specialty/practice setting.

A general concept to think about is what your Debt-to-Income ratio will be after graduation from training. (Example – if you make $200k as an attending, and you finish training with $200k in debt, your debt-to-income ratio is 1.) Life generally gets much harder if your debt-to-income ratio exceeds 2 – you will have far fewer life options (e.g. cutting back hours when you have kids or choosing a better but lower-paying job) because of your dependence on your income to make loan payments. This doesn’t mean you should eliminate specialties with a lower average salary – but if you anticipate accumulating $600k in debt by the end of your training, picking a practice setting within that specialty that makes at least $300k will give you far more options later in life.

Docs Currently in IDR Plans (SAVE, PAYE, ICR, IBR):

- Choice 1: Try to qualify for loan forgiveness. By July 2028, your only options will be IBR and RAP.

- Choice 2: Pay it off +/- private refinancing.

If you are currently in repayment and trying to qualify for loan forgiveness (IDR or PSLF), your only options will be IBR and RAP in 2028. Run the numbers on studentaid.gov to see how your monthly payment compares to IBR; if it is cheaper to stay, you may want to hold out until you eventually must leave SAVE/PAYE/ICR. You can also run the numbers for RAP once the program is available in July 2026. (The ED has stopped processing forgiveness for SAVE, PAYE, and ICR. Forgiveness for IBR has also been paused but will supposedly resume after updates are completed. This is separate from OBBBA, accurate as of Aug 1, 2025, and could change at any time.)

Or if you intend to pay off your loans, see what student loan refinancing companies are offering – you might be able to get a better payment plan than what the Federal Government is offering. Remember that once you privately refinance a federal student loan, you can’t go back – no more income-driven monthly payments, no loan forgiveness, no disability/death forgiveness, etc. But at least you won’t have to deal with the dizzying student loan policy changes either.

Additional Takeaways for Docs in SAVE Forbearance:

- It is only a matter of time until the $0 payments go away.

- Start saving money now and plan on making much higher payments no matter which path you choose.

The SAVE plan was extremely generous. Even before the administrative forbearance period that brought payments to $0 when the courts blocked its implementation, monthly payments were relatively low. Now, regardless of the courts, SAVE is going away by no later than July 2028.

If you stick it out in SAVE for as long as you can, you can keep enjoying the $0 payments each month, but you will not make headway toward either repayment or forgiveness. This is a reasonable short-term plan if you need to buy time or have a strategic reason to re-enter repayment later. (The ED has now made this strategy more costly since interest accrual has restarted for SAVE loan balances; accurate as of Aug 1, 2025, separate from OBBBA and could change changed at any time.) If you do nothing, you will eventually be switched into RAP.

Your options are otherwise the same as those in other IDR plans – IDR/PSLF forgiveness or payoff +/- refinancing. Either way, you will be paying far more each month than you were paying for SAVE pre-forbearance. Start setting aside money now to prepare for those inevitable higher monthly payments.

Even amidst the dizzying changes of student loan policy, staying informed and taking control will help you stay empowered as a physician. If student loans are impacting the wellness of you or your family, DocEmpowered is here to help. Book a free discovery call here.

If you would like to book a professional talk for your organization or colleagues about student loans or other financial wellness topics, reach out to us at speaking@docempowered.com.

1AAMC October 2024 Fact Card on Medical Education: Debt, Costs, and Loan Repayment Fact Card for the Class of 2024 (https://store.aamc.org/downloadable/download//sample_id/633/, accessed Jul 31, 2025)

Stanley Liu, MD, FACC is the Founder and Principal Financial Planner of DocEmpowered, LLC. He is also an independent practicing cardiologist, an award-winning medical educator, and the 2024-26 Advocacy Chair of Maryland’s American College of Cardiology Chapter.

Looking for wellness-centered financial planning for physicians, a professional speaker for your organization, or have a financial question for Stan? Book a free discovery call here.

Get more insights by exploring the DocEmpowered Blog.

Blog Feature Photo Credit: Vladimir Fedotov on Unsplash