One Big Beautiful Bill Act – (Part 2 of 3) – Changes to Charitable Contributions

Personal note from Stan 7/25/2025: My family will benefit from the tax cut extensions in the One Big Beautiful Bill Act (OBBBA), and it crushes me that huge cuts to Medicaid that will leave more of my patients uninsured is helping to fund that. Charitable contributions to organizations that help our most vulnerable neighbors is a priority for us. Whatever your motivation, understanding the new tax laws around charitable contributions can help you maximize your impact as a philanthropist.

Key Points:

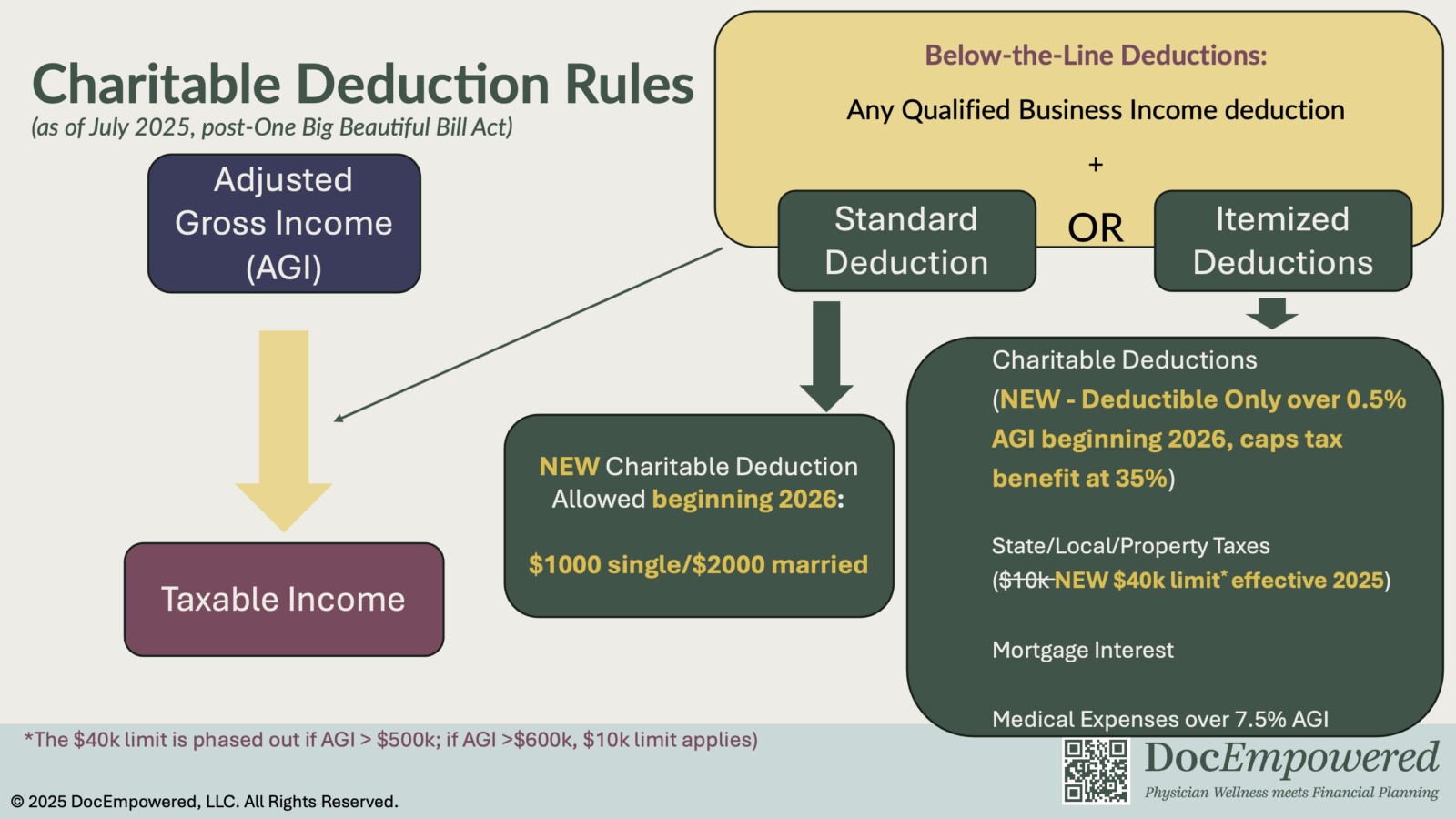

- Good news: If you take the Standard Deduction, you can now deduct up to $1000 single/$2000 married filing jointly for charitable contributions.

- Bad news: If you itemize your deductions, charitable tax deductions are more limited:

- Only contributions above 0.5% of your Adjusted Gross Income (AGI) are deductible.

- Charitable tax deductions are capped at the 35% tax rate (even if you are in the 37% tax bracket)

- Both changes take effect from the 2026 tax year on.

Background

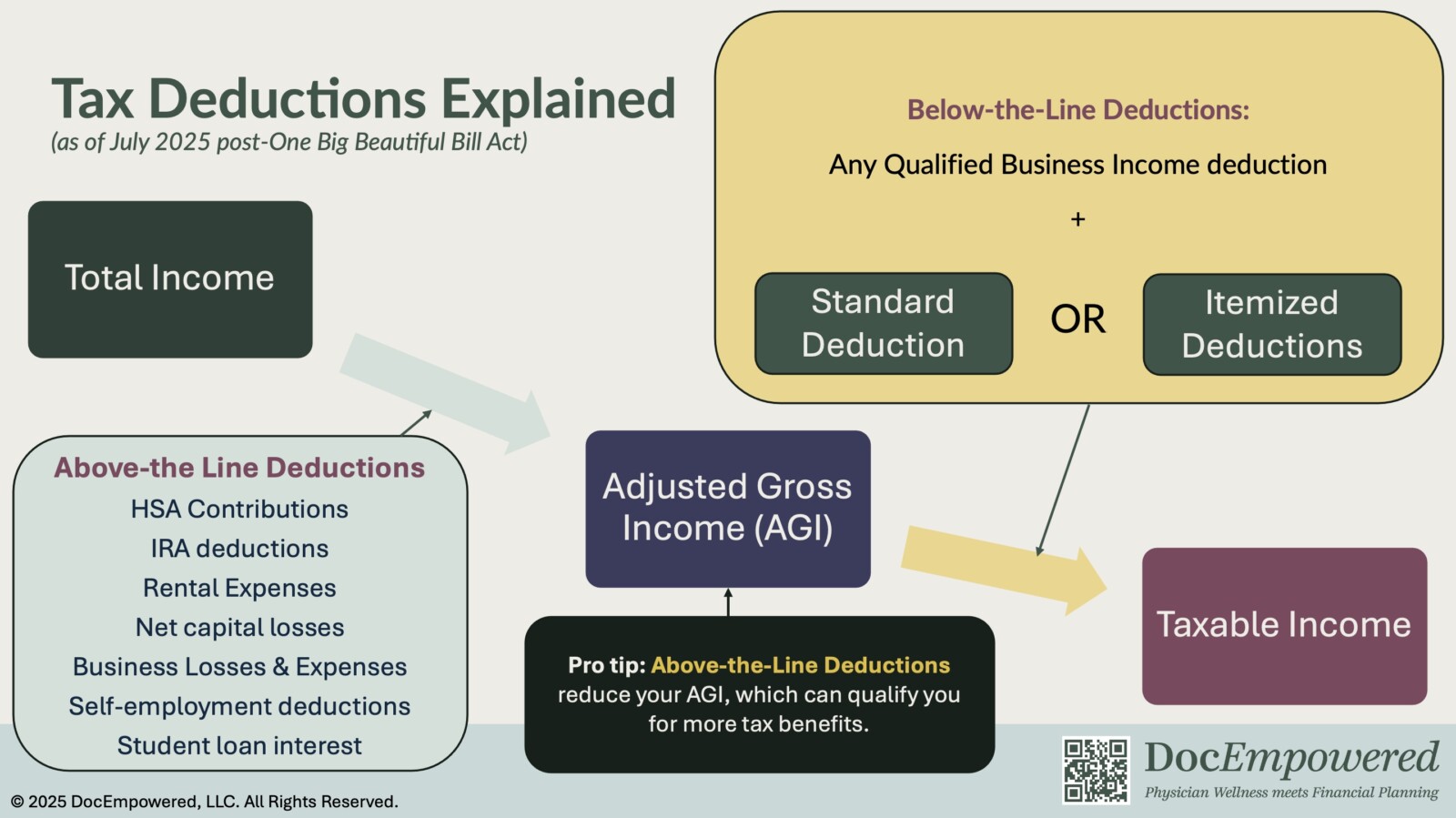

A quick primer on “Above -the-Line” and “Below-The-Line” tax deductions:

When filing your taxes, you choose between the Standard Deduction ($15,750 single/$31,500 married filing jointly in 2025 post-OBBBA, with annual increases) and Itemized Deductions (where you list out individual deductions). Whichever deduction you choose is subtracted from your AGI to determine your taxable income; for that reason, you generally want to pick whichever deduction gives you more.

For Itemized Deductions, OBBBA made changes to the State and Local/Property Tax (SALT) deductions and charitable contributions. To understand the two major changes to charitable contribution deductions, we’ll expand the Below-the-Line Deductions figure below:

Change #1 – New Charitable Deduction if you take the Standard Deduction

This is overall great news for donors who take the Standard Deduction. Previously if you took the Standard Deduction, there was no tax benefit to making charitable donations. The OBBBA has now created charitable deduction specifically for those taking the Standard Deduction that caps at $1000 single/$2000 married filing jointly. Donations to donor-advised funds or non-public charities are not eligible for this deduction.

Change #2 – New Charitable Deduction floor and maximum tax deduction rate if you Itemize Your Deductions.

This is bad news for donors who itemize their deductions. Previously, you could potentially deduct every dollar of eligible contributions up to a certain percentage of your income. Post-OBBBA, charitable contributions will only be deductible above 0.5% of your AGI.

As an example, let’s say your AGI is $200k, you itemize your deductions, and you donate $20k to charity that tax year. Instead of deducting the full $20k, you will only be able to deduct $19k ($20k – 0.5% x $200k).

The highest earners in the 37% marginal tax bracket get hit by another new rule: the maximum tax deduction rate is 35%. As an example, let’s say you earn $1000 subject to the 37% tax rate. If you were to donate it all, you would now save $350 in taxes instead of $370.

Actionable Takeaways for the Physician Philanthropist:

- If you take the Standard Deduction, keep track of your donations to qualify for the $1000/$2000 charitable deduction.

- If you Itemize Your Deductions, consider lowering your AGI through above-the-line deductions (such as retirement plan contributions). This will lower the 0.5% AGI floor and increase the amount of your charitable contributions that are tax deductible.

If you want to maximize your impact as physician philanthropist, DocEmpowered is here to help. Get started creating a comprehensive financial plan that prioritizes your charity goals here.

Stanley Liu, MD, FACC is the Founder and Principal Financial Planner of DocEmpowered, LLC. He is also an independent practicing cardiologist, an award-winning medical educator, and the 2024-26 Advocacy Chair of Maryland’s American College of Cardiology Chapter.

Do you want the power to serve your patients, family, and community on your own terms? If you need an evidence-based financial plan to help make that power a reality, book a free discovery call here.

Get more insights by exploring the DocEmpowered Blog.

Blog Feature Photo Credit: Katt Yukawa on Unsplash