Econ 101 for Docs: The Federal Reserve

Macroeconomics has a huge impact on physician financial wellness. Today, we’ll learn about the Federal Reserve from a high-yield and apolitical perspective that doctors need to know.

Key Points:

- The Federal Reserve (“the Fed”) is the U.S.’s politically independent central bank with two often-conflicting goals: maximum employment and stable prices.

- The Fed tries to achieve both goals by meeting regularly and deciding how best to manage short-term interest rates (i.e. the availability and cost of credit)

- Lowering interest rates provides relief to businesses and families during high unemployment but can lead to uncontrolled inflation. Raising interest rates keeps inflation down but can worsen unemployment/lead to a recession.

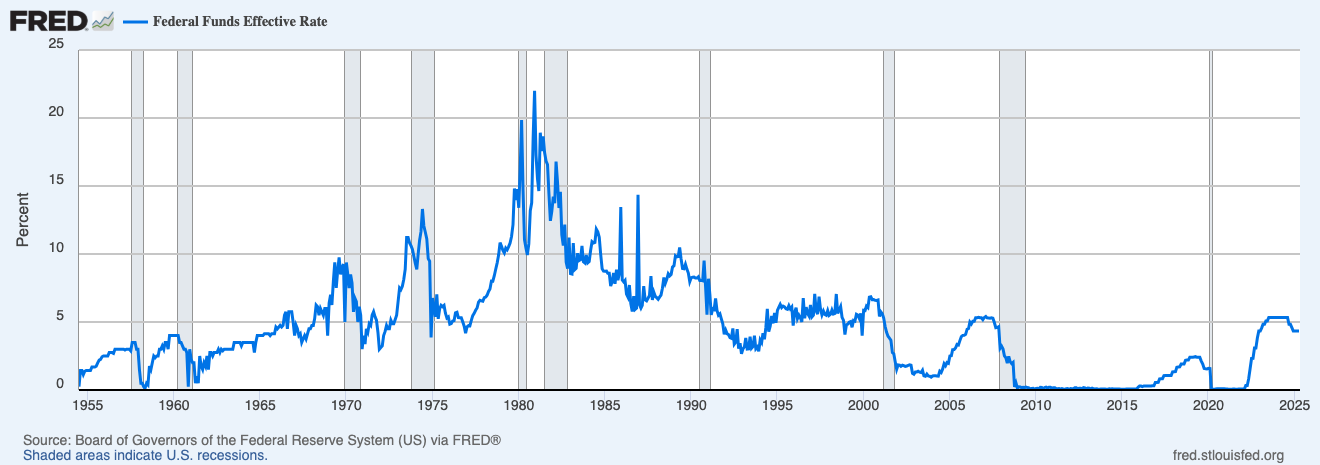

- What the Fed fears most: Simultaneously high inflation AND unemployment (“Stagflation”). This last happened in the U.S. during the 1970’s; the Fed’s attempts to relieve unemployment led to staggeringly high inflation that only reduced after two recessions in the 1980’s.

- What you can do during periods of unpredictable interest rates, unemployment or inflation: Ensure predictable and manageable interest costs. Build an emergency fund appropriate for the vulnerability of your income sources. Protect your purchasing power through salary negotiations.

The Federal Reserve (“the Fed”) is the U.S.’s central bank, established in 1913 to create a safer and more resilient banking system. It has the power to regulate short-term interest rates (i.e. the availability and cost of credit) and became politically independent in 1951. This independence is largely credited for the ability to come up with policies with a longer time horizon than a presidential election cycle.

The Federal Reserve has a mandate to achieve three goals: maximum employment, stable prices, and moderate long-term interest rates. We’ll focus here on the first two: maximum employment and stable prices. These two mandates often conflict with each other, so the Fed meets regularly to discuss and vote on how best to manage short-term interest rates. They can either raise interest rates, leave them the same, or decrease them.

Lowering interest rates: Provides relief to businesses and families during high unemployment but can lead to uncontrolled inflation.

During tough economic times, the Federal Reserve will lower interest rates, making it more affordable for companies and individuals to access credit. This helps preserve their ability to continue operations, pay employees, and buy needed services and goods. The best time to borrow money (e.g. securing a mortgage) is when interest rates are low.

However, there is a huge problem that can occur with lowered interest rates – if there is now too much money in the economy chasing too few goods and services, the prices of those goods and services rise, leading to uncontrolled inflation. People on a fixed income are particularly vulnerable to inflation, as their income now has less purchasing power. Savers also are penalized, as the low interest they earn on their savings cannot overcome the increased cost of living – their savings are actually losing real value.

Raising interest rates: Keeps inflation down but can worsen unemployment/lead to a recession.

When annual inflation increases beyond the Fed’s target of 2% per year, they can raise interest rates, which makes it more expensive to borrow money or access credit for businesses or mortgages. This restricts the amount of money flowing in the economy, and the decreased demand for goods and services helps to stabilize their prices. Savers are rewarded over borrowers when interest rates are higher.

The downside – if consumer spending decreases significantly and the economy cools too much, companies may have to scale back production and cut jobs to stay afloat. This can lead to increased unemployment and an eventual recession.

What the Fed fears most: Simultaneously high inflation AND unemployment (“Stagflation”).

The Fed’s worst nightmare is a prolonged period of both high inflation and high unemployment because fixing one problem can exacerbate the other. This last occurred in the U.S. during the 1970’s after the Arab oil embargo in 1973 led to a spike in oil and energy prices – prices increased everywhere as a result. Unemployment rose as companies cut costs, but the prices everywhere continued to rise.

The Fed at that time opted to lower interest rates to boost economic growth and decrease unemployment, but this led to uncontrolled inflation (as well as expectations of higher inflation, making companies unwilling to invest in new jobs or production). The Fed then raised interest levels to all-time highs in the late 1970’s and early 1980’s; it was only until after two recessions in the 1980’s when energy prices and consumption had both decreased, that inflation finally began to let up.

What you can do during times of unpredictable interest rates/unemployment/inflation:

- Interest rates: If you have a $600k adjustable-rate mortgage and your interest rate rises by 1%, that is an additional $6k per year you will have to budget for. Consider paying down or refinancing adjustable-rate debt so that interest costs are predictable and manageable. This protects you from a scenario where your loan payments become unaffordable if interest rates rise.

- Unemployment: As physicians, we’re tempted to think our jobs are recession-proof, but as we learned during the Great Recession and during the COVID pandemic, they’re not. Honestly assess the vulnerabilities of your income sources. If you own a private practice that is heavily dependent on elective procedures, for example, increased unemployment will mean fewer patients have insurance coverage or are willing to pay for those procedures. Take steps to boost your emergency savings while times are still good so that you will be able to weather periods of decreased income or unemployment.

- Inflation: Ensuring you get paid what you are worth will help protect your purchasing power if the cost of living rises. Salary negotiations informed by data on median compensation for practitioners in your specialty, geographic area, and practice setting can help you protect against inflation. Similarly, finding or creating other streams of income (e.g. through moonlighting or a side gig) can also help ensure you are able to keep up with rising costs.

Being informed and proactive in uncertain economic times can help put you and your family in a strong position even in times of economic uncertainty. If you need help creating a comprehensive financial plan, DocEmpowered is here to help. Get started here.

Stanley Liu, MD, FACC is the Founder and Principal Financial Planner of DocEmpowered, LLC. He is also an independent practicing cardiologist, an award-winning medical educator, and the 2024-26 Advocacy Chair of Maryland’s American College of Cardiology Chapter.

Do you want the power to serve your patients, family, and community on your own terms? If you need an evidence-based financial plan to help make that power a reality, book a free discovery call here.

Get more insights by exploring the DocEmpowered Blog.

Blog Post Cover Photo credit:Joshua Hoehne on Unsplash